Customer Value Framework for Modern Finance Tech In today's fast-paced business world, the finance...

Strategy of Finance (SoF) Summaries - EP 002

Strategy of Finance (SoF) Summaries

Learn. Grow. Inspire.

Summary of Episode 2 - Customer Value Enhancement through Internal Excellence with Jay Sahal, CFO at Yellow.ai.

Guest Intro

This Strategy of Finance podcast episode features a discussion with Jay Sahal, CFO at Yellow.ai.

Jay is a Chartered Accountant and Company Secretary by qualification and joined Yellow.ai in Dec 2020 after honing his craft for over 20 years in multiple large companies, including the IT giant Wipro. He spent over 15 years at Wipro leading the Finance function for various business units, including $1 bn+ Healthcare & Life Sciences BU.

Yellow.ai provides a generative AI-powered Dynamic Automation Platform (DAP) that empowers over 1,100 enterprises across more than 85 countries with conversations that accelerate their growth. It has raised over $100Mn of funding and has more than 1,000 employees across offices in six countries.

Episode Intro

Jay unpacks his professional journey and shares his views on the evolving role of the modern CFO, the impact of technology and automation on Finance, the CFO’s relationship with the CEO and the rest of the management team, what keeps him motivated, and advice for emerging professionals.

Listen to the full episode here:

Guest Quotes

"You are trying to change the tires of a fast-moving car, and you need that kind of agility, that kind of thinking process to do that. And you can't stop the car and change the tires... you should be able to manage dynamic environment in a better way, should be able to make quick decisions, and you should be able to do course correction very fast."

"Certainly right now, CFOs are business partners, CFOs are driving enterprise automation journey, CFOs are trying to manage risks for an enterprise end-to-end in a proactive way. I think going forward, given that more and more automation is coming, what an enterprise can give value to a customer will be linked to how they are operating internally, and CFOs will play a bigger role in driving that journey."

"Collaboration is a key skill I seek in people. Are you able to work with others? If two people are aligned, they are able to do five people's work. If they are not aligned, put together, they'll not do half people's work."

"In your core areas, you should look for improvement every week, every month, every year... One step at a time, every day, you make a difference, and you can break a mountain with small steps. So small steps of efficiency, small steps towards better experience, better output, better way to work, I think you'll be able to transform the organization."

Episode Summary

Jay believes that the role of the CFO has evolved significantly in recent years. Traditionally, CFOs focused on accounting, audits, cash management, and finance-related processes. However, the CFO's role has expanded with the advent of new business models and fundamental changes in industries. Today, a modern CFO walks the path with other management and is involved in automation, operations, and even HR policies. In startups, the CFO's role is even more diverse, ranging from leadership presence to filling the decision-making gap for founders who might be based in other countries to leveraging market presence. Further, the CFO's role has become more crucial in managing risks, especially around events such as those seen at Silicon Valley Bank.

According to Jay, COVID-19 significantly impacted the role of CFOs and finance departments, including changes in risk management, cash flow, scenario planning, and budgeting. It has also accelerated the need for automation and digitization in finance. He also notes that the pandemic and the rise in inflation and interest rates have affected startup funding. Jay suggests that startups should take advantage of the situation by pitching their services in a way that can help their customers improve their automation journeys, increase their revenue, and reduce costs. He recommends managing balance sheets and cash, transforming enterprise operations through automation, restructuring capital planning, and raising debts to ensure a long runway.

Looking ahead, Jay predicts that the role of CFOs will continue to evolve in response to the changing business landscape and emerging technologies. CFOs will have to become more data-driven and analytical in their decision-making, and they will have to be more strategic in their thinking. They will need to deeply understand the organization's business model, customers, and competitive landscape to drive growth and profitability. Further, Jay proclaims that the value an organization delivers to its customers will depend on its internal operational efficiency.

Jay emphasizes the delicate balance between agility and processes as a company grows. He explains that as the enterprise scales, it must put together its processes, such as an approval matrix, to ensure that each transaction is taken care of in a standard way, without creating exceptions every time. CFOs play a significant role in achieving this balance, and automation can help make the processes more efficient. The focus should always be on improving the company's growth while being cash-efficient and improving margins. Finance plays a vital role in keeping the chain together by making data available at the right time and ensuring every transaction is done efficiently.

Jay talks about the importance of the CEO-CFO relationship in any company and how he strengthens it by challenging specific outputs and keeping the business honest toward numbers.

Discussing his motivation, Jay highlights his mission to create a category-leading enterprise SaaS company out of India, which keeps him energized daily.

Jay's advice for aspiring CFOs or heads of departments in finance is to set ambitious goals for personal growth and focus on adding value to the organization. Collaboration with other functions and networking within the company is crucial while also aligning with the company's goals. Thinking about the big picture and finding ways to improve processes and efficiency continuously is also emphasized.

About Strategy of Finance Podcast

A podcast on Finance People, for Finance People, by Finance People.

We celebrate the Profession and the Professionals in the world of Finance with Rohit Agarwal, Founder of Krayo. These unsung heroes mostly remain under the limelight but contribute tremendously towards company building. This is our endeavor to unpack their journeys to understand what moves them, get inspired by their triumphs, learn from their experiences, and, most of all, connect with them at a personal level. Visit us at https://www.strategyoffinance.com/ .

About Krayo

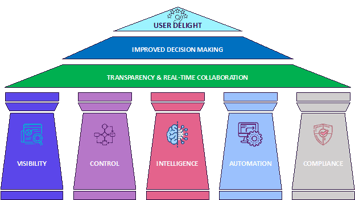

Krayo is the Unified OS for Corp Spend.

An all-in-one SaaS platform, Krayo brings together the whole journey of Spend: Buy (Procurement) >> Pay (AP) >> Manage (Asset Mgmt), with an intelligence-first and automated approach. It optimizes cash flows, enables real-time budget mgmt., provides complete spend visibility, scales operational processes, ensures policy adherence & compliance, and increases margins. Visit us at https://www.krayo.io/ .

2023 Krayo Inc.

All Rights Reserved.

2023 Krayo Inc.

All Rights Reserved.

Blog comments