Strategy of Finance (SoF) Summaries Learn. Grow. Inspire. Summary of Episode 2 - Customer Value...

Reset 100 - Part 3

Reset 100 – Part 3

'Tis the season for Budgeting

Welcome to Part 3 of the Reset 100 series. In Part 2, we touched upon the core prerequisites of any Planning & Budgeting exercise - a review of the market landscape and core KPIs.

Further, we also established the value of having a 3-yr financial plan to ensure enough of a line of sight being created to steer the company on the right path appropriately. So, in this part 3, we'll deep dive into the Budgeting process but more from a strategic point of view rather than how best to orchestrate it.

Budgeting is amongst the most potent tools in the CFOs toolbox with company-wide implications. Given its nature, it can only be used once a year (if done right) but has implications for the company and its people throughout the year.

We'll divide the topic into a few points for ease of understanding.

1. Scenario Planning

Companies across the board are looking to either become profitable or further increase their profit margins. Growth at all costs is a relic now. Even having 18 or 24 months of burn is no more good enough.

One has to make the business self-sustainable without any further outside funding. But given no one has a crystal ball to see how the future might pan out, the goal post to profitability is likely a moving target. Therefore, as the Board and Management focus heightens on monthly burn and runway available, it becomes critical for companies to do more detailed scenario planning now than ever.

A key but an often underexplored component of scenario planning is deciding on the vectors of the scenarios. A few essential questions to ask are:

- What macro phenomena are hard for an individual or company to influence at large, and what's in the company's control?

- Regarding top-line scenarios, should you consider the leading indicators like lead generation and resulting funnel, or should you directly consider the revenue growth?

- As the end market dynamics are changing and overall market growth declining, how much of a baseline do you consider for market growth? Did you implicitly assume a larger market share gain in your downside scenario?

- Employee attrition and its impact on top-line - how much do you ascribe to macro vs. micro?

- What are the Churn Rate and Net Retention Ratio assumptions for recurring revenue businesses?

One should work out a minimum of three cases to appreciate the various moving pieces in a business. Given that the company's macro variables are not controllable, there's an argument for using the same macro assumptions in Best and Base case but assuming a slight softness in the Bear case. Another key element to appreciate across the scenarios is the alignment of spending required to achieve a specific revenue. Most scenarios we have reviewed keep the expense side constant and only change the top line, which results in a very theoretical plan at best.

- Best Case

An all-stars align case, but caution is required not to turn it into a pie-in-the-sky unrealistic scenario. These numbers are achieved only with outstanding productivity and performance across the organization, and internally management teams should aim to achieve this case.

- Base Case

A pragmatic and more realistic case based on the information available at hand. This case should also become the Board-approved budget for the upcoming year.

- Bear Case

The conservative case with softer assumptions on both macro and company-specific variables. This case is a scenario that the company must achieve unless the macro environment deteriorates tremendously.

2. Existing Business vs. New Business P&L

It is a unique and very time-appropriate way of looking at your budgets. Unfortunately, only some businesses can generate new business without upfront investments, whether in R&D or marketing & sales. As everyone is chasing profitability now, even at the expense of growth, the first set of exercises should be to understand where a company stands on the profitability of its existing business. Let's term it EB P&L.

CFOs should look at every line item - revenue and costs - and create this EB P&L for the following year. All you are solving for is what you expect your existing customers to produce in terms of revenue over the next year and what all you would need to support this revenue across all the departments in the company. There would be some costs directly attributable in full and others which you might have to apportion. The EB P&L will give you a deep insight into your existing base, how profitable it is (or not), and what vectors you have to increase that profitability. One needs to think deeply about existing customer churn / contraction and any upsell that would happen to this base. The idea is to get to precision in this P&L. It's okay to be conservative here, but you can't afford to miss your budget for the Existing Business. A key result of this exercise is the cash levels you have available after considering this P&L, which can then be the guiding factor for your investments in New Business.

With this clarity, CFOs are much better armed to strategize on new business development and choose the best risk-adjusted RoI path. This exercise also allows for a better understanding of the Bear Case (as discussed above) and the quantum and timing of any further capital requirements.

3. Zero-base Budgeting

Cash is and will always be the king!

Zero-base budgeting is a very high-impact technique where you start from scratch and justify each dollar of spending rather than starting from the last budget and making a few edits. It's an essential tool in the modern CFO's kit to ensure spending optimization with enhanced returns.

Some of the critical areas that could potentially use some optimization include the following:

- Marketing / Distribution Channels - do not stop testing / exploring new channels, but overemphasize channels that have proven RoI

- Headcount planning - the mix of fixed-bonus-stock, strategy around increments for existing employees, and salary bands for new hires. It is also a great time to evaluate and execute any cost-arbitrage opportunities available for talent

- Software upgrade / optimization plans - check for wastage, mission-critical nature, consolidation opportunities of duplicate solutions

- Real Estate spend

- Services spend - SLA performance, renewal requirement

- Procurement negotiation - most vendors would show more openness on pricing negotiations in the current environment. Buyers should act strategically to get the best overall deal for each vendor. Given all businesses are valuing cash more currently, for mission-critical vendors, you may want to get a higher discount for upfront payment.

4. Milestone-based budgeting

A derivation of zero-base budgeting and scenario planning, this technique starts with assessing the zero-base bare minimum requirements to run an efficient business. One can also layer in a target cash number by the end of the budget period. Then you can set scenarios where if you achieve a particular milestone in Q1 on revenue and profitability, you can unlock x amount of additional pool in Q2 for investments, and so on. This cadence will ensure that cash flows are always in check and the company is better prepared to weather the winter as the year passes.

For a successful performance against the budget, CFOs should establish appropriate budget ownership across Functions and Categories of spending. In addition, periodic performance evaluation should ensure minimal deviations from the budget.

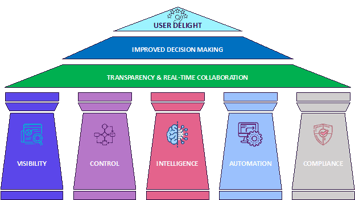

In the next part, we'll cover a few more exciting areas of finance, including incentive alignment, fundraising & investor relations, and systems & automation.

As always, we are happy to be a brainstorming partner and discuss ways to unlock your full potential. Do not hesitate to reach out to have a discussion. We care for your success!

***

2023 Krayo Inc.

All Rights Reserved.

2023 Krayo Inc.

All Rights Reserved.

Blog comments